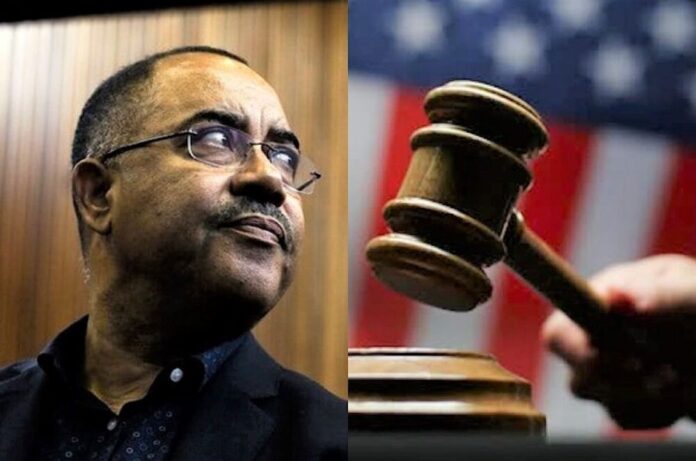

NEW YORK (CHATNEWSTV) — Manuel Chang, Mozambique’s former finance minister, was sentenced Friday to 102 months in a U.S. prison for his role in a $2 billion international fraud and money laundering scheme. Chang accepted $7 million in bribes to approve fraudulent loans, prosecutors said.

“Manuel Chang abused his position to betray the trust of Mozambique’s people while defrauding investors, including those in the United States,” said Brent S. Wible, Principal Deputy Assistant Attorney General for the Justice Department’s Criminal Division. “This sentence ensures Chang is held accountable for his violations of U.S. law.”

The scheme, orchestrated between 2013 and 2015, involved Chang and his co-conspirators misrepresenting the use of loan proceeds meant for maritime projects in Mozambique. The loans, guaranteed by the Mozambican government, were used to secure funding for coastal surveillance, tuna fishing, and shipyard development.

Instead, more than $200 million of the loan funds were diverted to pay bribes and kickbacks to Mozambican officials, including Chang. These actions caused Mozambique’s state-backed companies to default, resulting in over $700 million in losses to investors worldwide.

Carolyn Pokorny, Acting U.S. Attorney for the Eastern District of New York, emphasized the broader implications of the case. “Today’s sentence sends a clear message: foreign officials who exploit their positions to target the U.S. financial system will face justice.”

Chang was convicted in August 2024 on charges of conspiracy to commit wire fraud and money laundering. Beyond his prison term, he must forfeit $7 million, with restitution to be determined later.

The FBI’s New York Field Office spearheaded the investigation, with support from U.S. and international authorities, including South Africa, Switzerland, and the U.K.

“Chang violated the trust of his office to enrich himself and other officials,” said FBI Assistant Director James E. Dennehy. “This case reaffirms our commitment to dismantling corruption, no matter where it originates.”

Credit Suisse, one of the banks involved, previously admitted in 2021 to defrauding investors over a related $850 million loan. The bank paid $475 million in fines as part of a settlement with U.S. and U.K. authorities.