Economists care much about the health and how nations manage five mechanisms around their currency stability; that is, devaluation,revaluation,depreciation, appreciation and re-denomination.

For instance, a decrease in a currency’s value relative to other major currency benchmark’s is called depreciation (this happens through floating exchange transactions or market forces); likewise, an increase in the currency’s value is called appreciation. On the other hand, altering the face value of a currency without reducing its exchange rate is re-denomination. Meanwhile,

revaluation is the opposite of devaluation, that is a change in the exchange rate making the domestic currency more expensive.

Interestingly, amongst these mechanisms mentioned devaluation is most dreaded. Because this speaks volume of how a nation economy will be competitive in global trading.

What then is devaluation? Instructively, devaluation is an official lowering of the value of a country’s currency within a fixed or pegged exchange-rate system. This occurred when the monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. Hence this demonstrates the working of micro and macroeconomics as well as modern monetary policy,

In this case, a monetary authority in our clime that is the Central Bank of Nigeria (CBN) maintains a fixed value of the Naira ready to buy or sell foreign currency’s (US Dollar,Pound Sterling and others) with the Naira as a domestic currency at a stated rate.

Simply, currency devaluation is an indication that the CBN through the Deposit Money Bank (DMBs) will buy and sell foreign currency.

Although, apart from earlier monetary system to determined currency devaluation such as fixed or pegged rate.

Critically, there is also market forces determinant or floating exchange rate system. This system act not by CBN monetary action, rather the will to sell or buy on the foreign exchange market (supply and demand).

Grippingly, we cannot fail to mention that all the preceding are related in distinct to the concept of inflation. Another, monetary economic mechanism that monitor the value of the currency in terms of goods and services related to citizen’s purchasing power.

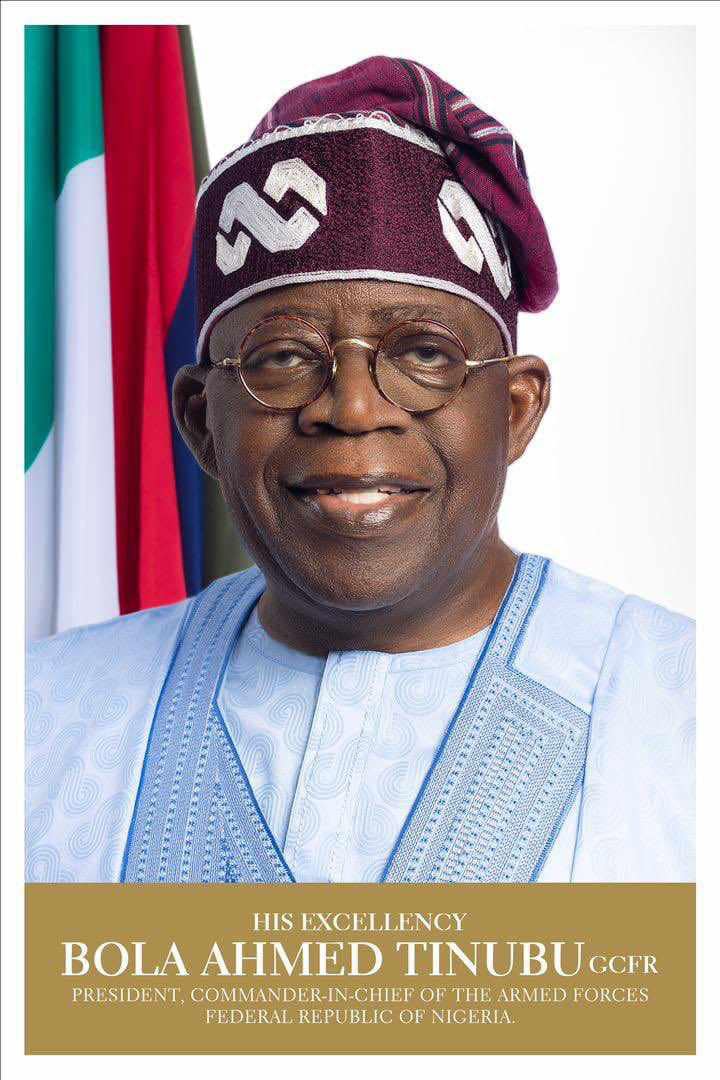

Expressly, the reasons for the above narrative are based on the recent media report that that the Central Bank of Nigeria (CBN) as devalued the naira to exchange for ₦630 to a dollar. And the report went viral on social media. The news of naira devaluations came 48 hours after President Bola Ahmed Tinubu announced the plans of the federal government to unify the country’s exchange rate to stimulate the economy.

Although, the Media Trust Group, publisher of Daily Trust newspaper first published it as an exclusive report.

However, in a swift reaction, the CBN through it Twitter handle, @cenbank, published a screenshot of Daily Trust’s report, with the words ‘Fake News’ branded on it. Adding, that this is “imagination of the newspaper, and the Investors & Exporters (I&E) window traded at ₦465/$1 on June 1”.

But responding in a statement, Daily Trust said it had evidence of those who bought the dollar at the reported rate, and challenged the CBN to provide any facts to the contrary. Stating that the

CBN had not provided any proof at the time of filing it report.

In what look a fight back CBN reminded us of her circular tagged: “Investors’ & Exporters’ FX Window”, dated April 2017. In which the monetary authority explained all about the new window benefit to “boost liquidity in the forex market and ensure timely execution and settlement for eligible transactions”

Further, the I&E window is described as “the market trading segment for investors, exporters and End Users that allows for FX trades to be made at market determined exchange rate”.

Instructively, on the I&E window naira exchange rate within this platform may differ from the CBN official exchange rate of ₦461.6

Understandably, the I&E window is not for every body. It is created for players operating on the corridor of investment, importation and exportation. Accordingly, an investors may buy forex from an exporter. In what is simply an insider dealing on the window, as two entities may wish to trade and exchange a dollar for naira above the CBN official exchange rate.

Nevertheless, as this happened between both parties in the CBN I&E window mechanism. All transaction have no bearing on the CBN official exchange rate.

The question that beg for answer is why then is the Investors’ & Exporters’ FX Window perpetuate naira devaluation for excess gains, round tripping and as an officially outpost for illegality amongst it player’s?

As reported in the media, manufacturers and investors are lamenting that

“Nigeria’s currency has been long devalued, according to business leaders from manufacturers to importers who say they have been buying dollars at N630 since the beginning of May”. This however is in contrast to the Central Bank of Nigeria refuted claims of “falsehoods and destabilizing innuendos, reflecting potentially willful ignorance of the said medium as to the workings of the Nigerian Foreign Exchange Market,”

A clear indication of what is happening in the CBN I&E window is a back door devaluation of the naira to enrich certain element in the system.

Although, having acknowledged, that FX market is sensitive, the platform must not be used to create uncertainty in the system. Nigeria operates a multiple exchange window, with the official rates (N464) trading well below the parallel market rate (N750).

Simultaneously, devaluation does have its benefits (increasing exports, diminishing trade deficits, and reduced interest payment costs on the due government debts) although except developing nations like our struggling with corruption and dysfunctional economic system. Devaluation challenges far outweigh it benefits as it bring about expensive imports,causes inflation,stifle FDIs, and long term negative effects on growth.

As it is been insinuated, that a 15% devaluation of the naira is among Tinubu’s earliest priorities, couple with government determination to removed petrol subsidy.

What then should be done? Noteworthy, currency devaluation as a monetary policy tool and mechanism to boost economic growth,especially trade through export is appreciated. Its shortfall and limitations are a priority’s the Tinubu administration should analyze critically, if they decide to rollout such a policy.

By Adefolarin A Olamilekan

Political Economist

Email: adefolarin77@gmail.com

Tel: 08107407870,08073814436